how much tax is taken out of my paycheck in san francisco

However they dont include all taxes related to payroll. That means that your net pay will be 43324 per year or 3610 per month.

San Francisco Rents Are Plummeting But Its Housing Crisis Could Get Worse San Francisco The Guardian

Paycheck Calculator Calculates net pay or take home pay for salaried.

. The payroll tax modeling calculators include federal state and local taxes and benefits and other deductions. How old are you. The 20 rate applies to income from 10001 to 20000.

Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer. FICA taxes consist of Social Security and Medicare taxes. See how your refund take-home pay or tax due are affected by withholding amount.

The federal income tax has seven tax rates for 2020. To find out how much personal income tax you will pay in California per paycheck use. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

Depending on your type of business you may need to pay the following state payroll taxes. 91 rows Brief summary. Subject to State Disability Insurance SDI has standard deductions.

The 10 rate applies to income from 1 to 10000. The table below details how Idaho State Income Tax is calculated in 2023. FICA taxes are commonly called the payroll tax.

Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. I would like the least amount of taxes taken out of my paycheck how to go about doing that. The income tax rate ranges from 1 to 133.

Only the very last 1475 you earned. No local income tax. For a single filer the first 9875 you earn is taxed at 10.

During the deferral period lasting through December 31. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Yes residents in California pay some of the highest personal income tax rates in the United States. California unemployment insurance tax. Estimate your federal income tax withholding.

Just a few quick questions to understand. And the 30 rate applies to all income above 20000. Use this tool to.

Just enter the wages tax withholdings and other information required. If you make 55000 a year living in the region of California USA you will be taxed 11676. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

The amount of federal income tax. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. The Income Tax calculation for Idaho includes Standard deductions and Personal Income Tax Rates and.

Youll pay this state unemployment insurance tax on. The Accountant can help. Nonresidents who work in San Francisco.

Free Llc Tax Calculator How To File Llc Taxes Embroker

How To Calculate Net Pay Step By Step Example

Visualizing Taxes Deducted From Your Paycheck In Every State

California Sales Tax Calculator And Local Rates 2021 Wise

How To Pay Little To No Taxes For The Rest Of Your Life

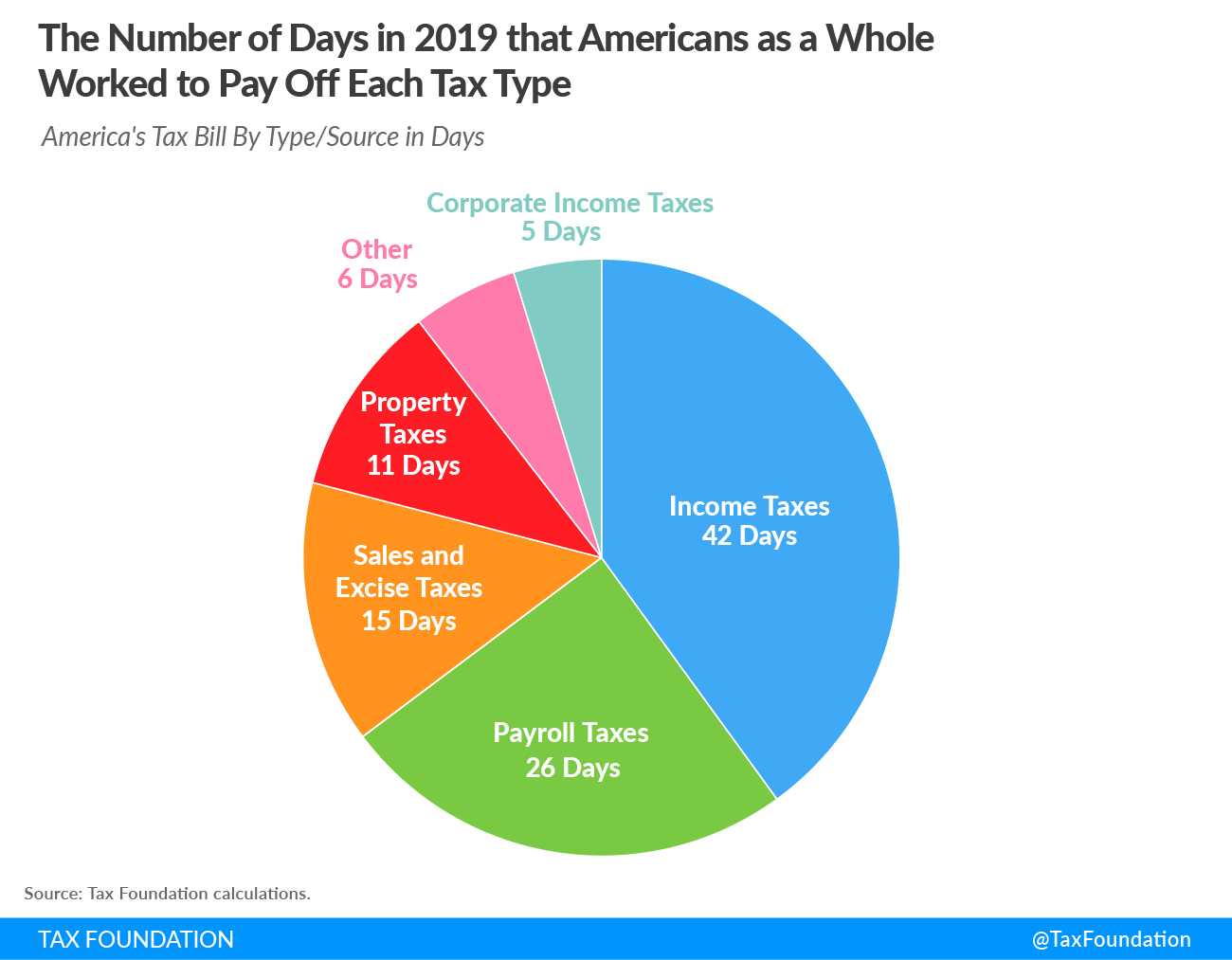

Tax Freedom Day Tax Foundation

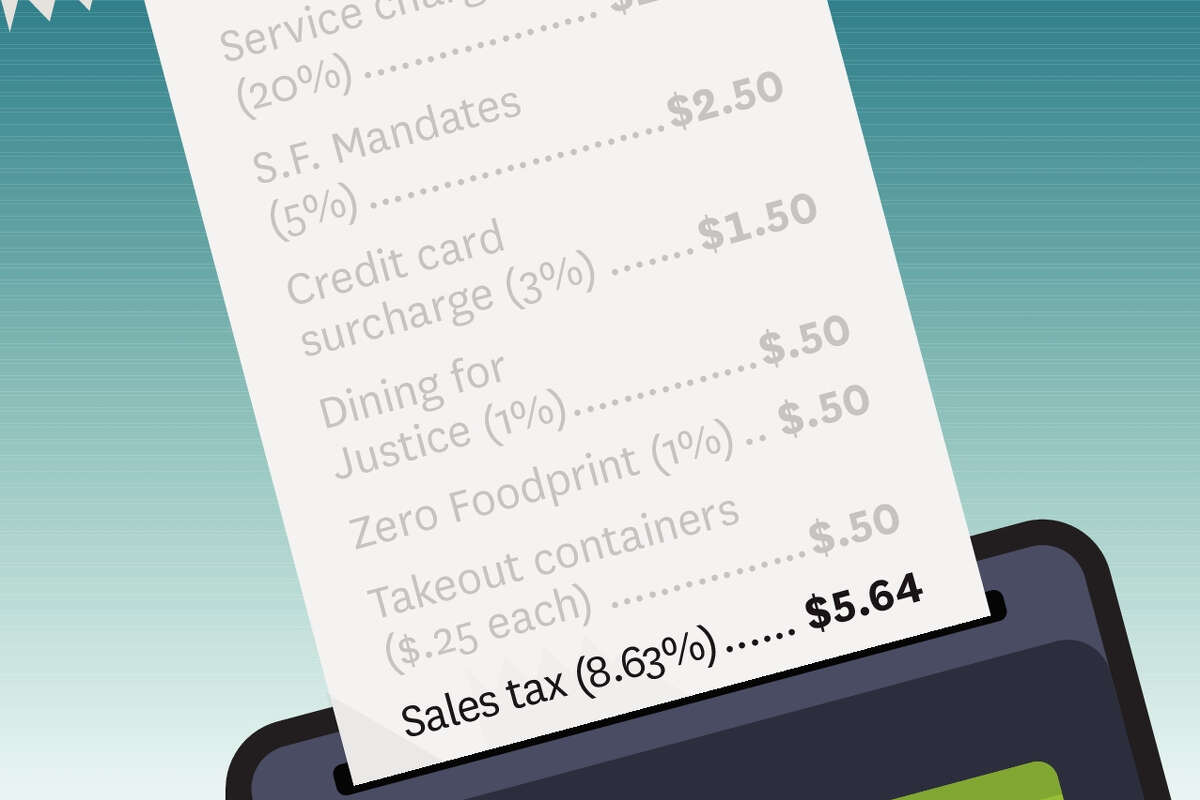

Did You Pay Way More At A Restaurant Than You Expected Here S How Bay Area Surcharges Work

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

California Paycheck Calculator Smartasset

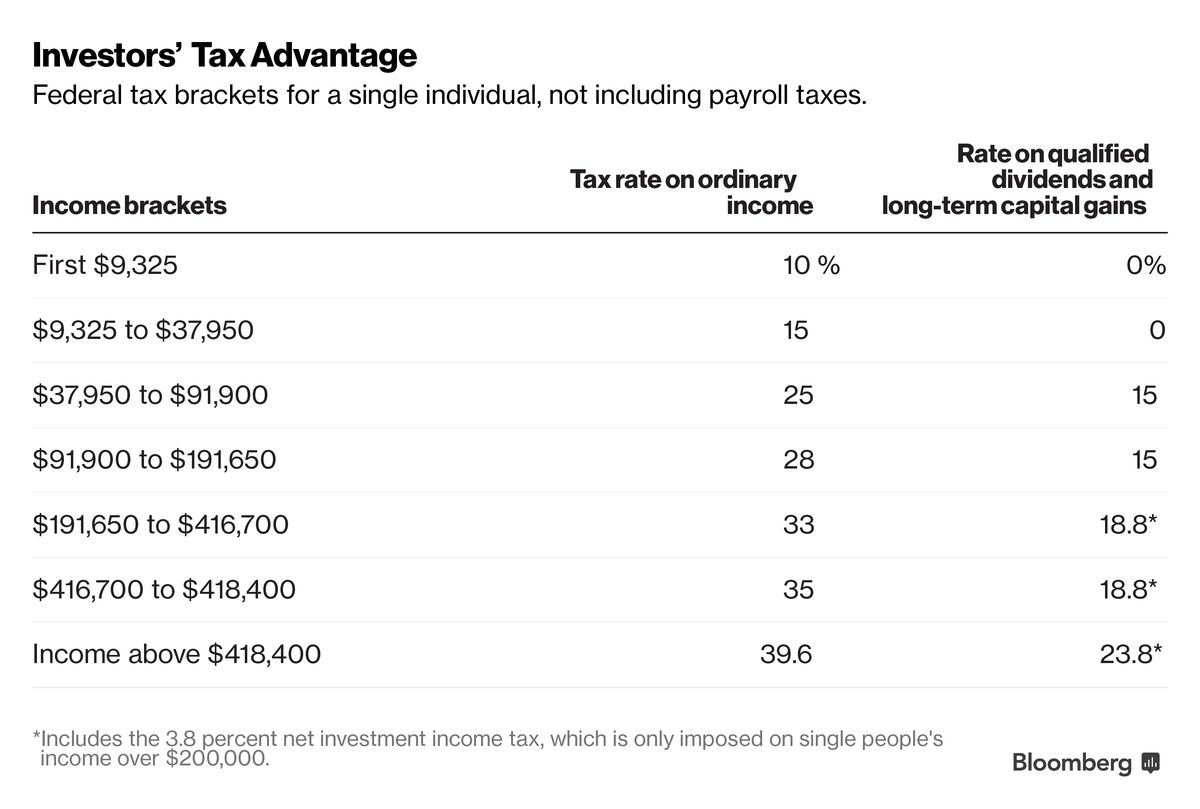

Why American Workers Pay Twice As Much In Taxes As Wealthy Investors Bloomberg

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

If I Get A Job In California That Pays 150k How Much Money Will I Get To My Account After Taxes Quora

Doordash 1099 Taxes And Write Offs Stride Blog

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

California Payroll Tools Tax Rates And Resources Paycheckcity

No More Deals San Francisco Considers Raising Taxes On Tech Wired

Income Tax By State What S Your Take Home Pay On 100 000 Salary